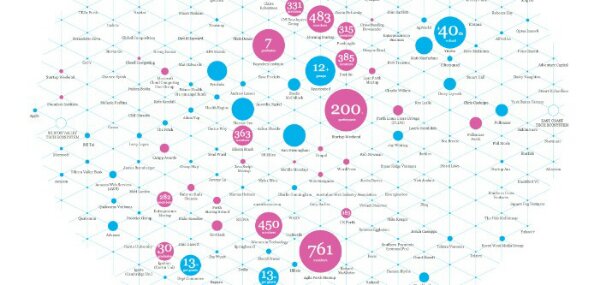

A recent report commissioned by the City of Perth found there are 2,500 people involved in tech start-ups in Perth. The same report also noted that there was only an amount equivalent to $3 per capita available to invest in them. Over in Silicon Valley there is $1,300 per person, in Israel $900, Denver-Boulder $500.

It is clear that Perth needs more investment capital if these companies are to get off the ground. Not just money though, a sophisticated approach in choosing between the best businesses, and the best mentoring should also nurture them through. Many of them will fail of course, although giving things a go and trying something new is no failure. Investors typically prefer entrepreneurs with a couple of failures behind them anyway.

What Perth needs is a few high profile winners. Companies that make a few million, have a good exit such that new funds can fund the next round of start-ups. The successful entrepreneurs and investors then have the confidence and experience to get more balls rolling.

This virtuous cycle has fed the creativity of California, Israel and Colorado. We have the people here, we have the ideas. All we need now are some more wins.

An alternative (longer) version of this post appears here

2,500 people? In a population of 2.2 million that’s less than 0.12%. With such a low concentration of technology friendly people I am not sure it is rational approach to invest here. It would be a bit like trying to start a wheat farm in Antarctica.

I remember a firm called Interzone. The article is available here. http://www.kotaku.com.au/2010/02/wa-dev-interzone-games-close-to-liquidation/

I understand that the government had a $500k grant available. Their choice was me with my game ‘robots verses zombies’ or interzone. The government went with interzone because we all know Australians don’t know what they are doing and the idea was that international firms would somehow grow an Australian industry. The was despite my Australian firm having a much better product of a 3d first person shooter and the interzone product being a roughly made 2d soccer game.

Well Interzone arrived and asked all the programmers to work for free. Interzone then left the country with the source code declaring bankruptcy and not paying anyone anything. The tax office was owed about a million.

My question is how can you expect others to invest in Australia when even Australians don’t invest in Australia?

Yeah, fair point. It’s not very developed yet, but I did manage to gain investors for my tech startup 14 years ago and in 2010 we all had an exit. Things are happening, I feel we need a bit if time and some wins. 100 high tech startup companies is not that bad, some have gained $1m-$10m investments so there is money around.

Well there is plenty of money around. It is all locked up in superannuation with very low returns. I understand Paul Keating set the superannuation system up in order to increasing savings, help fund retirement and support startups. I feel the superannuation industry has been hijacked by property and blue-chip investors. People have to understand that it is only with startups that you get the high growth required to fund retirement.

The failure of the superannuation system to invest in Australians means that most of the money for startups is sourced overseas. That may be satisfactory for some businesses, however, an Australian business really needs Australian money that understands the strange nature of the Australian markets.

What Australian needs is an innovation fund that can bridge the gap between angels investors and large superannuation funds. A search engine that matches appropriate businesses with mum and dad investors.