Nearly every topic of conversation this holiday time is veering towards bitcoin, and its amazing run up in value this year.

What is the bitcoin? How do you make money on it? Should I invest in it? Do you have some? How do you get some? It’s amazing right?

OK, hold on. We’ve seen this movie before, and it always ends in tears.

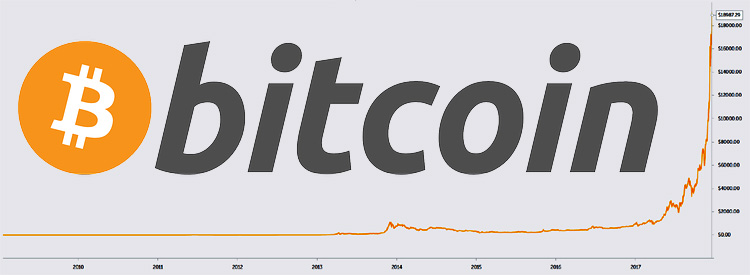

At the beginning of 2017, the price of the cryptocurreny (or digital currency) bitcoin was around US$1000. Today, it stands at 18 times that. How many things do you know rise in price by 18 times in a year and hold their value? Remember, in bitcoin’s case, there is no central bank, or government or gold providing security and ensuring there is some value there. It’s all based on trust.

Over the latter part of 2013, during a two month period, the price of bitcoin rose from about US$150 to over a US$1050. A 7-fold increase. People were calling that a speculative bubble, and they were right. From its peak, the price collapsed in a few days and stayed around $250-$500 for the next few years.

By January 2017 the price had crawled back steadily to $1000, and made its first attempted break out in April reaching $1250, only to fall back below $1000 again. All seemed reasonable. Every time it tried to jump out of its price band, it would fall back and behave like a ‘normal’ asset price should.

Then in May this year, it leapt out to a new record, $2000, and with a few self-correction (perhaps profit-taking) blips along the way a rocket fuelled run up began that took the price to $4000 in August, $6000 in October and $8000 in November. Each time it passed one of these milestones, there was an immediate drop, before taking a deep breath and climbing to new records within a few days. By mid-November it was on a geometric up slope, the kind of price increases you always see before a crash. The momentum has continued through December, starting the month just below $10,000 and now, 19 days later, almost doubling again.

No wonder it’s the topic of every barbecue, coffee catch up and dinner party.

Imagine investing $10K in it in January this year. It would be worth $180K today!

This type of steep rise only ends in a fall. And the steeper the rise, the harsher the crash landing will be. It has gone beyond rationality and flipped over into euphoria. A mate of mine’s every second post on Facebook is about bitcoin (“get in!“). When this happens, you know you are near the end.

If you look at previous speculative bubbles, which are easier to spot after they have burst, and the factors that have caused them, you can clearly see they are all present today in bitcoin:

5 signs of a bubble:

- Prices are sky rocketing exponentially

- Widespread media coverage

- Irrational exuberance over the asset

- People start to believe the hype

- People who don’t normally invest start to

As soon as you hear people say “we’re in a new paradigm!” or “this time it will be different!” then you know it’s time to bail.

Not only are these 5 warning signals shouting at us loud and clear right now with bitcoin, you don’t need a long memory to think back to the pre-GFC stock markets in the run up to 2008, or the house price rises prior to 2006 in Western Australia and the ‘mining boom’. I lived and breathed a tech boom during the dotcom bubble of 1999/2000 forming my own e-business during that time. When the crash inevitably came, we knew we would raise another bean for a while, and so it proved.

The bursting of the bubble

Once you have this irrational run up, a relatively minor event can burst the bubble and send prices crashing back down. The ‘Emperor’s New Clothes’ fallacy that had been holding it up is seen for what it is, and flight ensues.

For the dotcoms it was a famous Barrons article (‘Burning Up’) in March 2000 which explained how the land grab ‘revenue growth’ was slowing and most of the dotcoms only had a few months of cash left. As prices fell, people sold shares (if they could) precipitating yet more price falls.

Once those left holding bitcoin realise they are not worth $20,000 or more, then you watch as they try to get rid of them as fast as you can say ‘blockchain’.

When will it burst?

How much further can it rise? Markets have no upside ceiling, and people’s irrational exuberance can go on for a while. But burst it will.

Recent history may teach us a lesson…

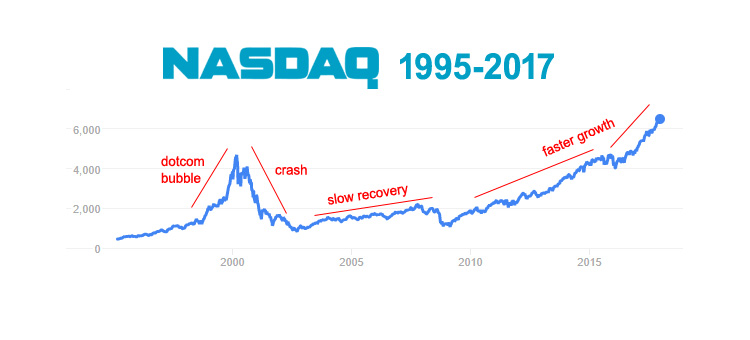

The world wide web was created in 1989 and went live for the world in mid 1991. At the outset, it was the domain of computer geeks. It was not until a few years later most of us even heard about this new technology. (Sound familiar?) Around this time we might have set up our first email address and started visiting websites. It was a few more years on that dotcom businesses started up trying to sell us everything online. By the time we heard of a few dotcom billionaires in the late 1990s, everyone and their grandmother was investing in dotcoms. The NASDAQ index ran up from 1,100 in late 1998 to over 4,600 in early 2000…

From the time of the WWW being given to the world to the ultimate crash of the dotcoms was 103 months (~ 8 and a half years).

Bitcoin went live to the world in January 2009. Add 103 months to that and you get August 2017. So the bitcoin run up has already outlasted the creation of the world wide web and the dotcom boom.

Drilling down further, you could argue the NASDAQ bubble began in earnest in Oct 1998 and popped in March 2000, 17 months later. The bitcoin bubble started in March this year, so according to this expect a burst around August next year. Somehow, given the strength of the bitcoin bubble (18 fold rise over 11 months, as opposed to the NASDAQ’s quadrupling over 17 months) one thinks it could come much sooner than that.

Return to form, price landing

If you examine the NASDAQ chart closely, you can see that the exuberant run up during 1999 was corrected by the crash, then a slower rise through to late 2015, and then a slightly increased growth of the index throughout 2016 and 2017. The index is now even larger than at the peak of the dotcom boom. The difference this time is that it is being driven by actual results, not spin and marketing fluff. Google, Facebook, Apple, Microsoft & Amazon are now 5 of the largest companies globally, and are producing immense (and increasing) revenues and profits. They are trading at fairly sensible multiples of 18, so don’t seem over priced.

Where will Bitcoin land, post crash?

I have no idea, but you’d expect it to be in the range of its pre-bubble trend, which was around $1000-$2,500.

Although I am fascinated by the blockchain itself, I am not going anywhere near bitcoin, or any other coins (including ICOs) for that matter. Nor, you may be interested to know, is Warren Buffett. He didn’t invest in dotcoms either.

A great read Charlie, well done!

3 comments from LinkedIN, where I also posted this article:

Tim Mazzarol –

It doesn’t matter whether it is ordinary shares, electronic money or tulips. The pattern is the same, and the fool and their money will soon kiss each other farewell.

Vince Cheng –

This bubble is shaping up to be the biggest, global bubble of our lifetime. And in doing so will change our world.

People forget that Bitcoin itself has already experienced 3 (4?) bubbles in its 9 year history. Each time ending with a higher support level.

But there’s also many people looking from the outside-in without ever really trying to understand the fundamentals of the technology, macro view and what’s really going on under the hood. Instead they mentally ascribe convenient mental models and heuristics to shoo away a technology that will radically change our lives…. And in doing so create trillions of dollars of future value.

Kristen Turnbull –

Literally as I read this two people at a bus stop are discussing investing in bitcoin. Nuff said.

Lots of commentary on my post on LinkedIn…

~ Tulip bulb craze in the 1630’s?

~ ~ Could be similar – wait and see.

~~ its more useful than a tulip or a simple commodity to be compared i think. Who knows. I invested/gambled on litecoin in february 2016 and so far its increased in value 92 fold. Its been fun actually and if i lost it all tomorrow it would have provided more entertainment than Netflix

~~ I’m not sure but Tulips are beautiful and so is Bitcoin

~ Sold mine recently , I’m ok with that .

Scary stuff for sure . Wise man says “only risk what you are willing to lose”. You may make shed loads but you may lose shed loads.

~

Yet more from LinkedIn…

~ Funny how NASDAQ is compared to Bitcoin, not crypto as a whole. Maybe a comparison to an individual stock is more relevant.

And Tulips? Well last time I checked, Tulips did not promise a revolution to the way commerce is conducted.

Bitcoin definitely is not the next Google, it is more like the Alta Vistas and Yahoos.

However from this market a Google or Apple inc will rise.

Lets compare Apples with Apples people!

[my point of using the NASADAQ index was as a proxy for the dotcom bubble]

Co-founder is selling http://www.theage.com.au/business/markets/bitcoin-as-good-as-useless-says-bitcoin-com-co-founder-20171218-p4yxty.html

4 days after writing this article, the price of bitcoin crashed by almost half its value (down to $11K at one stage Thursday 21st), to ‘recover’ to about $5K down, or 25%, from its peak at $15K (it had reached $19K on 17th Dec, 2 days before I wrote the article). Another run up is not out of the question, nor is a more complete correction over the next days and weeks

http://www.news.com.au/finance/money/investing/bitcoin-loses-nearly-half-its-value-in-187-billion-wipeout-as-crypto-correction-continues/news-story/fc40b9f1b11d07011c0b95dc7659bfa1