7 years ago I visited a New York real estate technology conference, and one of the main themes was the emergence of the mobile economy, and how important smartphones were becoming. On returning, I wrote one of my first blog posts (‘It’s mobile, stoopid‘) on the Business2 website, the first comment of which still reads: “I don’t think so…”

3 years earlier, Apple’s iPhone had heralded the onset of the smartphone era, and business was never going to be the same again.

Wind on to today, the smartphone is everywhere. This device has changed how we communicate, receive information and news, take photos, and how elections, products and almost everything is determined. Half the world wide web traffic is now over a mobile device. We’ve got access to all the world’s information, anywhere, anytime.

Back in January 2010, we did not even have the iPad, Samsung or Android phones. Many of us were not yet on Twitter. Instagram (established in October that year) and Snapchat (2011) did not exist.

Snapchat went public last week, and by the end of its first day of trading, was valued at US$33 billion.

Just take a moment to think about that.

An app, mainly used by kids to send quick greetings and filtered photos of themselves to each other, with hundreds of millions of dollars of losses, is worth more than all but 8 of the 2,000 publicly listed companies on the Australian stock exchange.

Snapchat, who famously refused a US$3 billion offer from Facebook in late 2013, is worth more than Woodside, Woolworths, Macquarie Group, QBE, Coca Cola Amatil, the REA Group… way more.

Snapchat, something dreamed up around 5 years ago. And it only ‘exists’ on a smartphone. Such is the power of the mobile/smartphone platform.

And so we turn to 2017, and as we move inexorably to the end of the current decade (less than 3 years now til 2020!), what will be the next big thing?

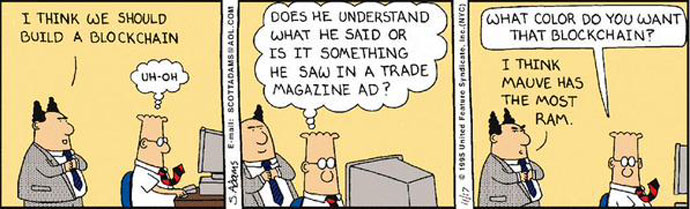

Some are tipping the Blockchain.

A whole world of mystery surrounds the blockchain. It is not easy to describe, or explain, and even its inventor is a mysterious Japanese person (persons?), who was (were?) rumoured to be living near Esperance.

You may have heard of Bitcoin, the online currency built off the blockchain platform, itself something invented only recently, after the GFC in 2008. But the blockchain (like the world wide web itself) can spawn many applications beyond bitcoin.

Simply put, the blockchain is a secure online ledger, providing permanent asset transaction summaries. Each asset, and each transaction (buying or selling) has its own ‘block’ linked together in ‘chains’, hence the blockchain – a line or even matrix of blocks chained together.

The key point to remember is that each unique block (a time stamped record) cannot be altered, ever. This is because this record is sent out to all the millions of computers around the world that are linked to the blockchain. Once sent out, it cannot be altered. It’s a permanent record.

The implications of this are that any asset transaction (such as transferring money or property or a contract or a share) can be uniquely recorded, and be immutable, irrefutable, unchangeable. This process can also happen quicker, and cheaper, than using a traditional intermediary.

So, potentially whole rafts of intermediaries (such as banks, real estate agents, any middle person really) can be disrupted away by the blockchain. The blockchain gives confidence to those involved in transactions (buyers and sellers) in the same way any broker or middle person might have done so up to now.

The reason the blockchain is so strong, and unhackable, is that as it is made up of individual blocks, that exist on millions of computers, simultaneously. In many ways, it has characteristics of the world wide web itself. Interspersed, with no single person in control. Anyone trying to change anything would have to have control of all those computers with access to a blockchain, and all blocks, at any one time. This is deemed impossible, and gives the blockchain its inherent power.

Once people start to recognise the simplicity and strength of the blockchain concept, they will start to trust it, and use it, to transact. Once this happens, banking, real estate, contracts, voting, stock trading, car exchanging and almost every market which involves ‘assets changing hands’ (which is what markets essentially do) could be disrupted and changed forever.

So, the blockchain could be the next biggest invention since the world wide web itself.

For hundreds of years we’ve had intermediaries help us with most of our transactions, as it’s too hard to run around and meet everyone in the market, and do it all ourselves. If the blockchain can do this for you, who now needs these intermediaries?

Yes, this may seem far fetched, but then again an app that makes funny filters for kids is now worth US$33 billion, and counting. 10 years ago, the devices on which it sits did not exist.

Remember also that Apple, almost bankrupt 20 years ago when Steve Jobs returned to the helm in 1997, is today the most valuable company in the world, at US$617 billion. Google, which did not even exist in 1997, is worth US$532 billion, and is the second. Rounding off the top 3 is another tech giant, Microsoft, at US$483 billion.

All these companies, and millions more, rely on the world wide web for their existence, something that did not exist until 1990. With the blockchain now out in the cybersphere, what else will be changed in the next 10 and 20 years? Perhaps pretty much everything.

~~

If you want to know more about the Blockchain (I’d strongly advise it), watch this 18 minute TED Talk by Don Tapscott.

[…] I am fascinated by the blockchain itself, I am not going anywhere near bitcoin, or any other coins (including ICOs) for that matter. […]